|

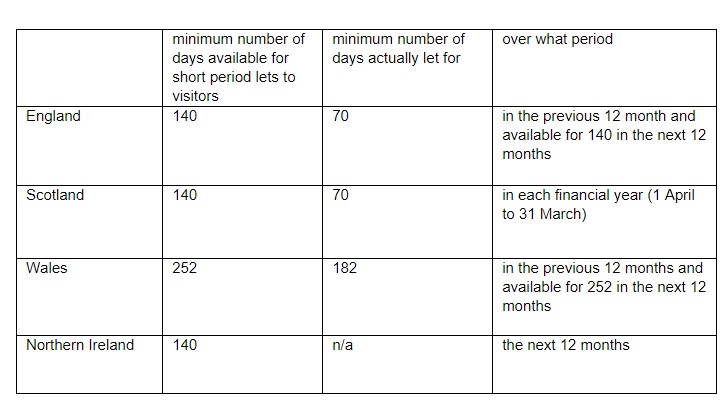

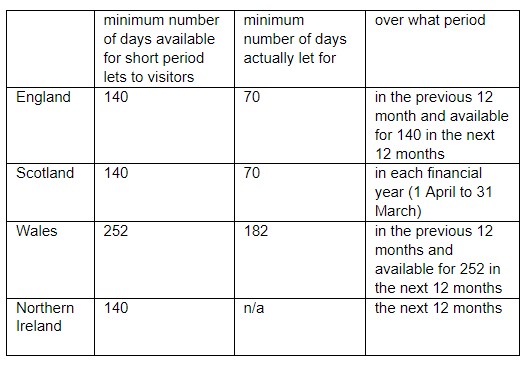

Business rates (Updated 14.01.2025) In 2023 the thresholds for holiday lets being eligible for business rates changed in England, Wales and Scotland. Here is some information around the current thresholds, how to register and the financial benefits of doing so. If you wish to register or remain registered for business rates rather than council tax, the minimum number of days your property needs to be let/available are: |

|

These thresholds are designed to show that the property is operating as a self-catering business. Bear in mind that bookings from family or friends that aren’t let at a commercial rate won’t count towards the totals. On the Owner Portal you can see how many days you have let your property with us.

Self-catering properties on business rates are often eligible for small business rates relief (which depending on the value of the property may mean you pay no business rates). You can contact your council to see whether your property is eligible.

These are a few of the top actions you can take to secure bookings:

If you need support to help you reach the target, please contact our colleagues in our market pricing team on 01244 345700, option 3 and option 4 and we will help you acquire as many bookings as possible. If your property is already on business rates: The Valuation Office Agency (VOA) aims to check each self-catering property on business rates every two years. If the VOA sends you a form you must return it within 56 days or they will move your property onto council tax which could cost you more. The VOA then might ask for evidence of the days you have let the property. This can be taken from the Owner Portal for bookings through us but you may also have other bookings you would need to evidence. If the property no longer meets the applicable threshold above, you'll need to tell the VOA who will put the property onto council tax from the date the threshold was no longer met. If the property meets them again in the future, you can tell the VOA again and they will put the property back onto business rates. If your property is on council tax but you meet the days threshold above: You should ask for the property to be assessed for business rates as follows:

More information: You can find more information, including about small business rates relief on our page here.

|